Businesses looking to invest in growth as uncertainty lessons

The latest update from our International Business Report (IBR) provided some encouraging signs for the health of the global economy. On the back of easing demand conditions, both investment plans and business confidence are up.

Are we finally seeing some light at the end of the tunnel of economic uncertainty? The answer is: I hope so.

Resolution of the so-called ‘fiscal cliff’ in the United States certainly helped. The sequester has since kicked in but businesses do not seem unduly worried about the spending cuts or the debt ceiling negotiations to come. Recent jobs numbers disappointed but growth forecasts remain steady.

Japan has perennially been at the foot of our global optimism league table, but a new Prime Minister, a new Central Bank governor and a US$116bn stimulus programme – which aims to boost GDP by 2% and add 600,000 jobs – have boosted business confidence.

The situation in Europe remains tricky – France has replaced Japan at the bottom of the optimism league table and is joined in the bottom ten by seven European neighbours. The bailout of Cyprus could yet have contagion effects, however overall demand conditions seem to be improving.

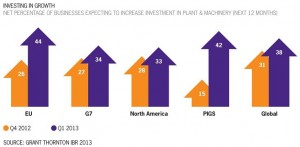

The key point is that business investment is a more attractive (and less risky) proposition in a more certain macroeconomic environment. And the investment figures are particularly encouraging. If firms feel confident enough to invest (and 38% in our survey do – the highest since 2007) then this bodes well for supply chains and jobs – and therefore for growth prospects.

Businesses have been hoarding cash, leaving reserves at record levels – approximately US$1.8trn in the United States and US$1.5trn in Europe. This is significant financial firepower. Let’s hope improving external conditions encourage them to use it.